Liquidity providers

Coverage client's orders on the Forex Liquidity Providers

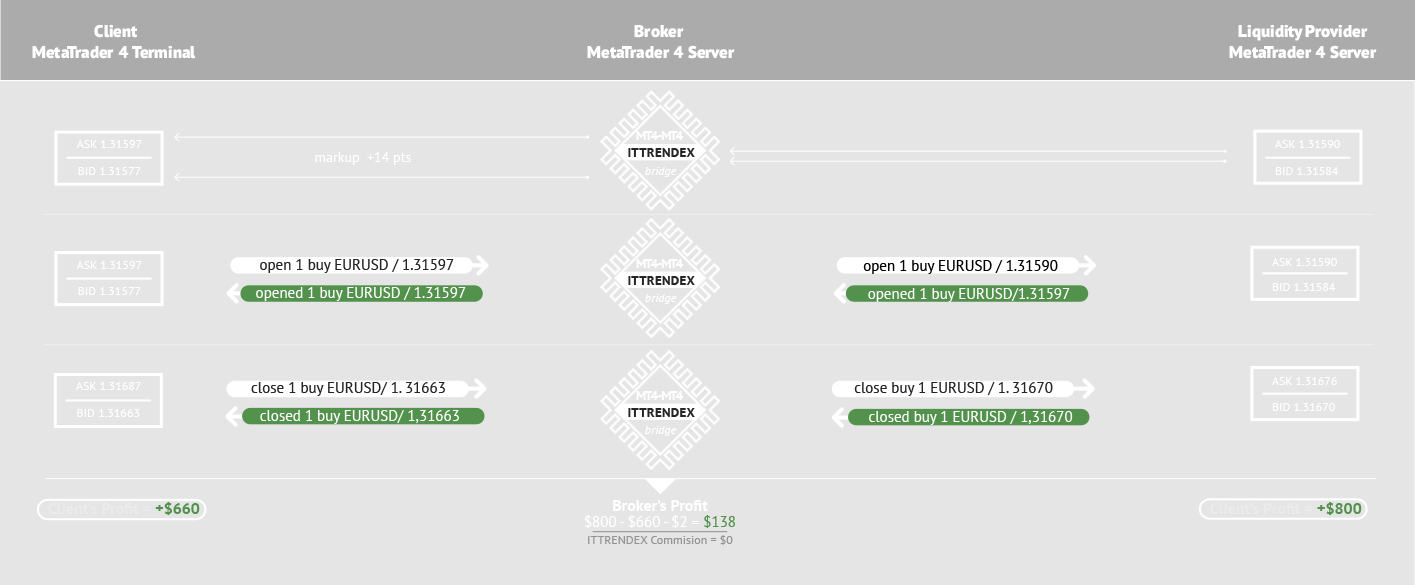

Description of process of client's transmission and broker's benefits

In recent years the market situation has changed as well as the client. There are no abrupt changes in exchange rates. All brokers offer high leverage which increases risks for the broker. Also on the broker risks affect the ever-growing competitive offers that generate different client earnings with client's no-risk schemes such as: "bonus hunting", "swap hunting", "arbitration" and others. The percentage of clients who earns in the Forex market has grown. Naturally, the broker who do care about their reputation and has no adequate financial reserves has to pass the high-risk customers to larger players (liquidity providers). Liquidity providers have an access to the liquidity of the banks and do can not afford to pay a large income of his client.

The first advantage of transmission of client's requests to liquidity provider is descension of broker's risks. If the client gets profit the broker does not worry about where to get money to pay client's profit as a broker has a profit on the account at the account of liquidity provider.

The second advantage is the income from client's trading. Broker's income that transmits his clients is formed by markup. Thus, the broker receives income from customer trading in any case, even if the client get profit.

The third advantage is that the client does not feel negative interference of broker in his trading and thus has no problems with the execution of orders. This increases customer loyalty to the broker.

The fourth advantage is that the liquidity provider provides with quotes feed and broker can extend the range of trading instruments offered to its clients through quotation source of provider and to refuse in part or entirely on third-party providers to save the money on it.

If risk descension and retention of a major customer is all logical and understandable, then look at how the broker earns in transmitting of his customers to liquidity provider.

Example of Broker's profit

1. Broker registers a coverage account at liquidity provider (LP) which will receive transmitted client's orders. Broker tops up the coverage account to start service work.

2. We offer a liquidity provider with the average five-digit spread of 6 points (0.6 in case of four-digits). The prices at the time of the transaction on the account liquidity provider are

ASK 1.31590

BID 1.31584

Broker's average spread is 20 five-digit points (2 in case of four-digit). The prices which the client sees the Broker's terminal are

ASK 1.31597

BID 1.31577

As you can see the broker provides the client with a spread wider than it is in the coverage account at LP. Execution on the server of LP happens at the best price.

3. The client opens a BUY position with 1 lot for the ASK price 1.31597. On the liquidity provider's side the order is opened at a price of 1.31590, ie the price is better than client's price on 7 points.

4. When client closes the order there will be the same. Client closes at a BID price 1.31663 and on the liquidity provider's side order closes at a price of 1.31670 which is 7 points better than the client's price again.

As a result if the client gets profit at broker, the broker receives profit on the liquidity provider's account but more than 14 points due to expanded markup.

If the figures, if the customer has earned $660 then Broker earned $800. In case of payout to the customers the Broker gives to client his earnings of $660 and gets a rest of profit of $140 with which he pays $2 (=$138) commission to LP.

Scheme of work

1. You choose a suitable liquidity provider from our list.

2. You contact us any convenient way for you by following contacts and we discuss all the details.

3. We generate a suitable conditions of the Agreement for you.

4. After signing the contract you will get registered coverage accounts at LP which is necessary to start transmitting client's orders.

5. Company provides with the licensed copy of the Bridge MT4 plugin for your MetaTrader 4 trading server and produces pre-installation and configuration of client's transmission system. The company also provides with tools to transfer the trading history of accounts and accounts with open positions.

6. We do tests of transmitting system together.

7. After successful tests you begin to transmit your client's orders and the liquidity provider will provide with reports of coverage account. Also you will be able to connect to your account to view all movements on the coverage account real-time.

Liquidity providers

| Name of liquidity provider | License type | Demands | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Mayzus Investment Company Ltd. | The company is licensed by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08. | European license required | ||||||||||||||||||||||

Liquidity provider details

|

|||||||||||||||||||||||||

|

|

Tifia Investment Limited | The company is registered as a provider of financial services in New Zealand with the license FSPR FSP310606. | Any license required | ||||||||||||||||||||||

Characteristics of client's transmission at Forex

|

|||||||||||||||||||||||||

|

|

TopFX | One of the largest liquidity providers in the Forex market | No license required | ||||||||||||||||||||||

Characteristics of client's transmission at Forex

|

|||||||||||||||||||||||||

|

|

AMB Prime | Offers liquidity provision and Prime Brokerage services for banks, brokerages and professional traders alike. | No license required | ||||||||||||||||||||||

Characteristics of client's transmission at Forex

|

|||||||||||||||||||||||||

Documents needed to start working with liquidity provider

Bridge Client plugin settings

- AllowPendingOrders – the flag of processing of requests for the creation of pending orders;

- AllowModifyRequests – the flag of resolution of processing of requests for modification of orders;

- AllowDeletePendingRequests – the flag of processing of pending order's requests removal;

- Dealer – dealer login to process requests;

- DefaultMarkup – local markup;

- ExternalSymbolPostfix – postfix added to the symbol name when sending the request to the bridge;

- Filter_Group – the filter of accounts by groups which should be processed;

- Filter_Login – the list of accounts which should be processed;

- Filter_Login%Iu – the additional lists of accounts (need to change %Iu by the number from 1 to the necessary number) which should be processed;

- FilterSkip_Login – the list of accounts which should be skipped;

- FilterSkip_Login%Iu – the additional lists of accounts (need to change %Iu by the number from 1 to the necessary number) which should be skipped;

- Filter_Symbol – the filtration of requests handled by the symbol (default is a complete ban);

- Filter_TickSymbol – the filtration of incoming quotes for throwing prices by local symbol;

- Filter_ZeroSpreadSymbol – the filtration of symbols with zero spread;

- InvertOrders – the flag of inversion of the direction of orders which were sent to the bridge;

- LiquidityProviderServer – server and the port on which the bridge works;

- LiquidityProviderClientName – login for check the connections to the bridge;

- LiquidityProviderPassword – password for check the connections to the bridge;

- LogZeroSpreadSymbolsDbg – the flag of activation of debug logging of symbols with zero spread;

- LogCommunicationStats – the flag of activation of logging of querying the server side and get answers;

- LogRequestAquiring – the flag of activation of logging of the accepting of requests for processing;

- LogTicksAdding – the flag of activation of logging of thrown quotes;

- LogTicksAddingOnTrade – the flag of activation of logging of prices thrown when processing requests;

- MaxZeroSpreadSlippageVolume – the maximum volume of the order with zero spread for which acts slippage from MaxZeroSpreadSlippage setting;

- MaxZeroSpreadSlippage – maximum slippage when opening an order with zero spread;

- TicksToSkipOnConfirmTickAdd – the number of ticks that must be skipped on tick that is thrown upon confirmation request;

- ProcessPendingsAsMarketOpen – the flag of activation of processing of pending orders as transfer of MK_OPEN requests on activation;

- ProcessStopoutsAsMarketClose – the flag of activation processing stop-outs as the transmission of requests MK_CLOSE;

- ProcessStopsAsMarketClose – the flag of activation of processing of Sl/Tp as transfer of MK_OPEN requests (values of Sl/Tp do not transfer);

- VolumeCoeff – the coefficient of modifying of the volume of order transmitted to LP server;

- ZeroSpreadSlippageControl – the flag of activation of slippage control of quotes with zero spread;